Swap It, Don’t Break It

Imagine you are China. You sell a lot of

stuff to the world. In fact, your whole economy is based on selling

things to the world. You have an incentive to make trade as smooth as

possible with other countries especially when it comes to making

payments.

|

But you have another dilemma. You are

not a wholly open economy. You like to control your currency as much as

you can to make it undervalued in a way that benefits your

manufacturers. If you let the currency trade freely like the dollar or

Pound, the market will probably value it higher than you want which will

make your products more expensive.

So, the way you can achieve this is by

tightly controlling the amount of your currency that is available around

the world. Unlike the US dollar that is widely available around the

world to the extent that countries like Ecuador can decide to adopt the dollar as their currency without getting permission from the US, you can’t do that with the Chinese Yuan.

These 2 issues — trading with the world

and tightly controlling the circulation of your currency — are in

tension with each other. So how to solve it?

A Simple Story of Swaps

Or if you prefer the ‘technical’

name — Bilateral Currency Swap Agreements. Depending on who initiates

the swap, a simplified version will work something like this.

Nigeria wants to make life easier for

its traders who buy a lot of stuff from China. As Nigeria doesn’t sell

much to China, it is not easy for the CBN to build up Chinese Yuan

reserves. This means that for any trader who wants to buy stuff from

China, they have to get prices in dollars. This adds costs and risks

given that the person in China giving the quote has to convert Yuan to

dollars before sending to Nigeria, bearing in mind the risk of currency

moves affecting his bottom line. The Nigerian guy then has to buy

dollars to make the payment to him. From the point of view of the CBN,

this is extra dollar demand that can be avoided.

So CBN approaches the People’s Bank of China (PBOC) and asks to set up a swap. Xe.com

tells me that 1 Chinese Yuan is currently worth about N30. So for the

sake of simplicity, let’s say CBN offers to swap N30bn for Y1bn. Both of

them agree an exchange rate on the day of the swap (N30 to Y1) and they

make the transfer.

Now that CBN has some Yuan, it can then

sell it to Nigerian banks in the same way it sells them dollars. The

Nigerian trader can then tell his Chinese trading partner to give him a

quote in Yuan instead of dollars. Once he has the Yuan quote, the trader

can then go to a Nigerian bank and make a request for Yuan in the same

way he used to make requests for dollars. Instead of the headache of

dealing with 3 currencies, the dollar element is now removed and we have

a normal 2-way quote.

This takes off some dollar demand

pressure as people who want to buy stuff from China can face their Yuan

squarely while the dollar people face their dollars. At least we get to

know who is who. All of this is, of course, conditional on the amount of

Yuan being swapped.

But what are the Chinese guys going to

do with their N30bn? Same thing — they can now pay in naira for anything

they buy from their Nigerian trading partners.

Chinese Swaps

For a number of years now, the Chinese

have been entering into these swap agreements with various countries on a

country by country basis. The swaps typically last for 3 years after

which they are renewed and/or increased. As an example, in 2012, the UK

signed a swap agreement for Y200bn with China. Last year, it was extended and increased to Y350bn.

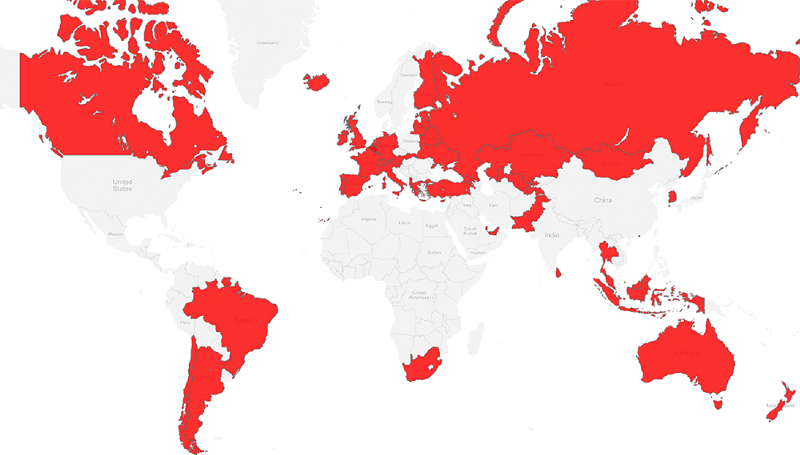

The map below shows the countries that had swaps with China as at 2015, per the PBOC

|

| China’s bilateral currency swap agreements with other central banks — 2015 |

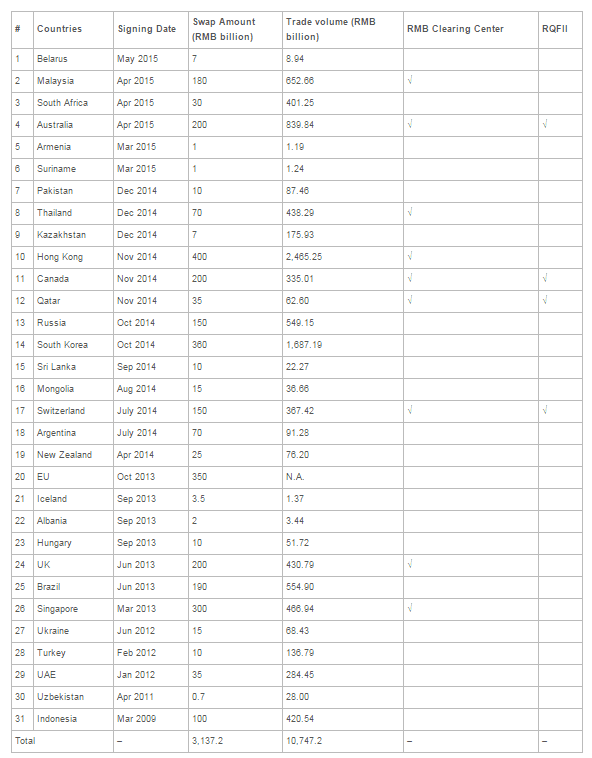

And here’s a table with the agreements and amounts swapped.

|

| China’s swap agreements and its counterparties — 2015 |

As you can see, Nigeria is coming very

late to the party. Perhaps, this might open the gates in Sub-Saharan

Africa. It’s also clear they are done on a country by country basis

depending on the amount of trade that goes on between them (although the

exact correlation is not so easy to work out).

You’re probably asking — if the

agreements are for 3 years, what happens at the end? In theory, both

countries simply exchange currencies at the same exchange rate they used

at the beginning of the swap.

Returning to the example above — Nigeria

will return the Y1bn to the PBOC and take back its N30bn from them. If

this sounds too good to be true, it is. The person who initiated the

swap will pay interest on the money it received at an agreed interest

rate.

So What Did Nigeria Swap?

Given the above, inquiring minds

probably want to know how much Nigeria swapped with China and when does

the agreement begin? Well, this is Nigeria and nothing is ever

straightforward as it should be.

|

| “Nice to meet you, President Eleven Jinping” |

First of all, it appears that the swap Nigeria entered into

was with the Industrial and Commercial Bank of China (ICBC) — the

world’s largest bank by assets. That is, the CBN is not dealing with the

PBOC but with a ‘private’ Chinese bank (ICBC is owned by the Chinese

government).

Second, I have trawled the internet and

cannot find the amount that was or is being swapped. As you can see from

above, there has to be an amount swapped for it to make any sense. I

have searched Chinese news outlets and even ICBC’s news page

and cannot find anything on the swap let alone the amount. The news

appears to have originated from Nigerian officials who briefed the

media. In contrast, Dangote did get a $2bn expansion loan from ICBC and

this was announced.

When They Come Back Home

So that’s that about that. Perhaps when

they come back home from China, we will get more details from them. But

based on this, we know what questions to ask (I’m talking to you

Nigerian journalists).

Why was the swap signed with ICBC and

not PBOC? How much is being swapped and for how long? And (bonus

question), what is the interest rate to be paid? (We can assume the CBN

initiated the swap and will be the one to pay interest on the Yuan it

receives). How will the Yuan market be priced? Will it be another

‘official’ and parallel rate mess like we currently have with the

dollar? This is a trick question because, if it is market priced, we

shall have plenty of fun with the contradictions in pricing the dollar

‘officially’ and the Yuan by the market.

FF tweets via @DoubleEph

This piece was initially published on Medium.com. Republished here with permission from the author.

You can get now get this app : Duplicate Files Fixer and Remover Apk

ReplyDelete